Understanding Journal Entries under the New Accounting Guidance (FASB ASC842)

The Journal Entry Report at Transition in LeaseCrunch, Line-by-Line

With implementation of the new standard, journal entries will change. In this article, we'll walk through the initial journal entries for both lease classifications, Finance and Operating at the time of transition.

When the Journal Entry report is pulled in LeaseCrunch, chances are, the first month detailed will show the initial recognition of the ROU Asset, the Liability, and the subsequent journal entries for the month. The entries for the first month of transition will be slightly different than subsequent months and for new leases.

The examples below are identical leases in terms, payments, and discount rates. The only difference is lease classification. Isolating this variable assists in gaining understanding of the journal entries and recognition.

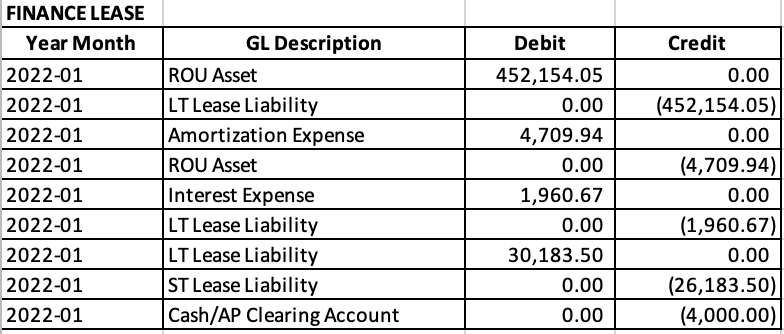

Finance Lease

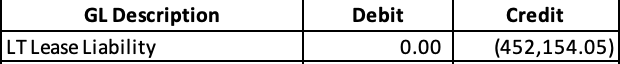

Beginning with a Finance Lease, the initial journal entry at transition will resemble this:

Let's break them out further...

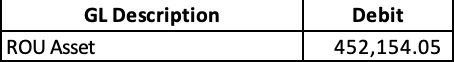

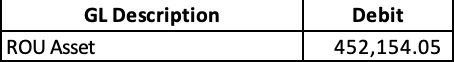

Initial recognition of the ROU Asset

Sum of:

The amount of the initial measurement of the lease liability

Base Lease: Any Lease Payments at or before the 15th of the month of the Start Date

Any Initial Direct Costs

Less: Incentives Received

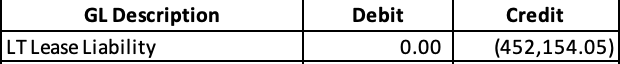

Initial recognition of the Liability

Present Value of Lease Payments

Software Note:

The Payments from 1st - 15th of first month of lease will be excluded from Liability (in PV calculation) but included in the ROU Asset. Lease Payments prior to Start Date will also appear in month of Start Date.

Transition Leases: All Payments are included in Liability (PV calculation). No payments can occur prior to Start Date (ie Initial Application Date) Payments can't be after End Date.

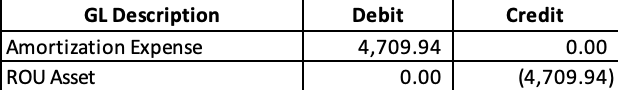

Amortization

Straight line amortization of ROU Asset over the useful life/lease term.

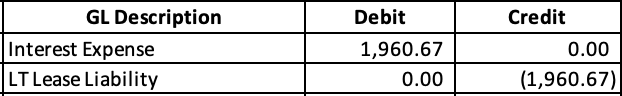

Interest Expense

This is the monthly Interest on the Lease Liability calculated as the Discount rate divided by 12* Prior Month's EOM Long Term & Short Term Liability (less BOM Payment).

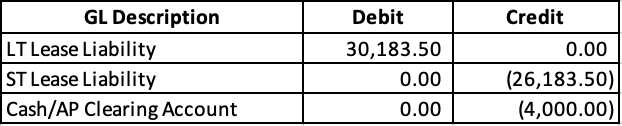

Short Term and Long Term Liability Recognition & Cash Payments

Long Term Lease Liability = Amount of Liability that is greater than 12 months from this point in time + cash payment as reduction of liability.

Short Term Lease Liability = Amount of Liability that is less than 12 months from this point in time. The short term portion of the liability is calculated and disaggregated from the long term liability to remain GAAP compliant.

Cash = Lease Payment

Operating Lease

Let's move on to an Operating Lease!

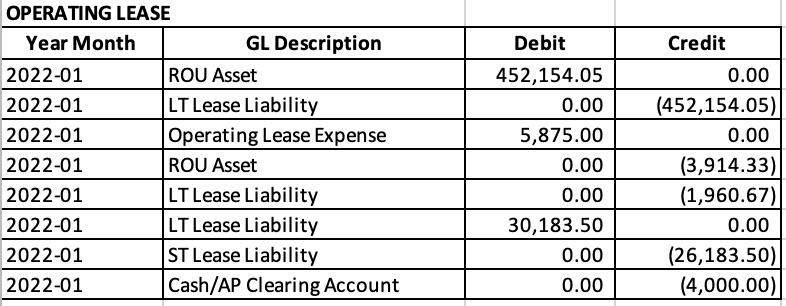

The initial journal entry at transition will resemble this:

Let's break these out further as well...

Initial recognition of the ROU Asset

Sum of:

The amount of the initial measurement of the lease liability

Base Lease: Any Lease Payments at or before the 15th of the month of the Start Date

Any Initial Direct Costs

Less: Incentives Received

Initial recognition of the Liability

Present Value of Lease Payments

Software Note:

The Payments from 1st - 15th of first month of lease will be excluded from Liability (in PV calculation) but included in ROU Asset. Lease Payments prior to Start Date will also appear in month of Start Date.

Transition Leases: All Payments are included in Liability (PV calculation). No payments can occur prior to Start Date (ie Initial Application Date) Payments can't be after End Date.

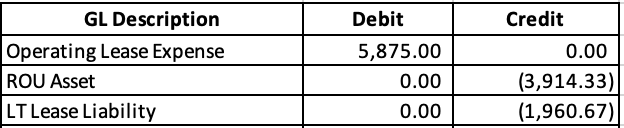

Operating Lease Expense

Operating Lease Expense = Total Lease Payments divided by ROU Asset Useful Life/Lease Term. Under ASC 842, this is no longer the matching entry to the cash payment on the P & L.

ROU Asset reduction = Straight Line Amortization of the ROU Asset cash payments over Useful Life/Lease Term minus the current Liability interest expense.

LT Lease Liability increase = This is the monthly Interest on the Lease Liability calculated as Discount rate divided by 12* Prior Month's EOM Long Term & Short Term Liability (less BOM Payment)

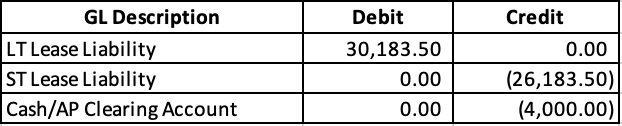

Short Term and Long Term Liability Recognition & Cash Payments

Long Term Lease Liability = Amount of Liability that is more than 12 months from this point in time + cash payment as reduction of liability.

Short Term Lease Liability = Amount of Liability that is less than 12 months from this point in time. The short term portion of the liability is calculated and disaggregated from the long term liability to remain GAAP compliant.

Cash = Lease Payment