Webinar Recording: Accounting for Every Lease Type: Real Estate, Equipment, and More

Not all leases are the same, and small differences can significantly impact accounting treatment. In this webinar, Jess Vento from LeaseCrunch and Matt Jensen from The Bonadio Group break down the key distinctions between real estate, vehicle, and equipment leases under ASC 842 and GASB 87. They discuss what to watch for when classifying leases, common challenges, and best practices to stay compliant.

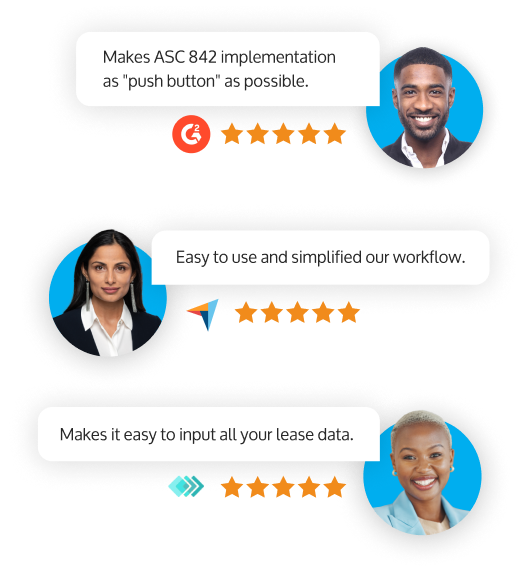

The Easy Way to Do Lease Accounting

-

Keep clients compliant with ASC 842, GASB 87/96, and IFRS 16

-

Expedite your clients’ lease accounting

-

Get step-by-step wizards to complete worry free calculations that comply with the new lease standard

-

Create error-free amortization schedules and entries

-

Save time with comprehensive policy templates that are designed to kick-off implementation

-

Modification or re-measurement calculations for revised leases

0

CPA Firms

0

Companies

LeaseCrunch is a simple, scalable, cloud-based solution that allows CPA firms and companies to automate the new lease reporting requirements with ease.