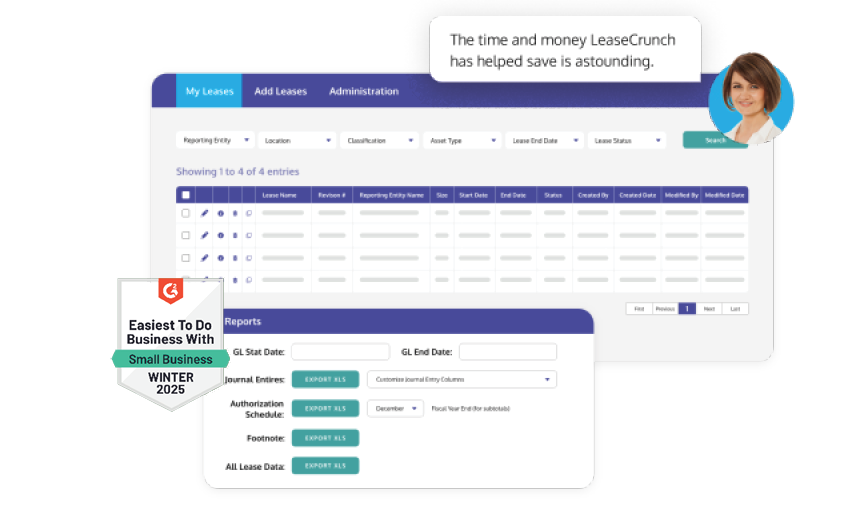

LeaseCrunch Verify for CPA Firms

Easier lease audits for your clients’ lease accounting calculations.

Quickly Conduct Client Lease Audits

Auditing your clients’ lease accounting, whether they used their own software or spreadsheets, is time-consuming and complex.

Efforts made to verify inputs within lease contracts, understand your client's chosen lease accounting tool, and then audit the accuracy of the calculations can take hours or even days.

LeaseCrunch Verify is a trusted source for auditing lease accounting calculations. The easy-to-use application reduces the hours required to perform a lease audit, giving your firm better economies of scale.

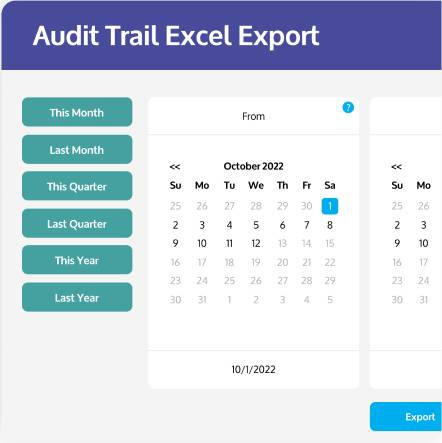

Audit Lease Balances

With LeaseCrunch Verify, simply enter a sample size of your client’s lease accounting portfolio, and export the Amortization Schedule to audit:

-

Lease assets at the beginning of the year and end of the year

-

Short-term and long-term lease liability at beginning of the year and end of the year

-

Amortization expense

-

Variable expenses

-

Interest expense

-

Modification or re-measurement calculations for revised leases

Save Time and Reduce Complexity

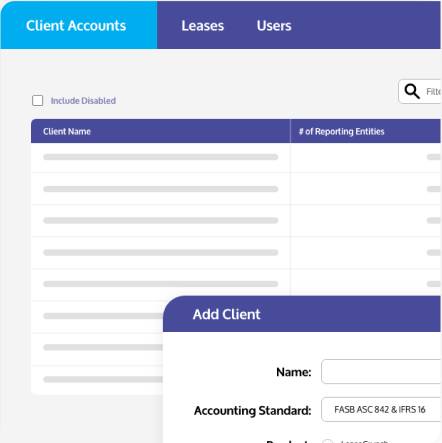

LeaseCrunch Verify allows you to add your client accounts from a single dashboard and test a sample size of their leases. Better yet, invite clients to enter the lease information directly into their own secure account.

With LeaseCrunch Verify, leases can be manually entered in minutes or by using the bulk import feature, which significantly reduces overall time and complexity.

LeaseCrunch Verify also features context-sensitive help, tooltips through the application, and in-app wizards that capture and derive the answers to subjective questions for inputs, such as classification and term.

Sensitivity Analysis on Client Errors

Using our automated Amortization Schedules, quickly assess whether incorrect client inputs will require an adjusting entry. Inputs that frequently require analysis include:

See LeaseCrunch In Action

Schedule a demo today to try our best-in-class lease accounting software for free!