Finance vs. Operating Lease: Which is Right for You?

The Financial Accounting Standards Board changed the lease accounting game forever when they declared the ASC 842 new lease accounting standard.

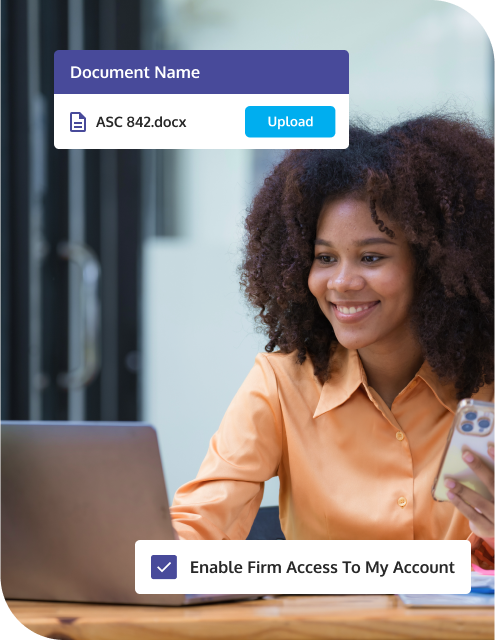

Set up, manage, and report on all your leases in minutes with our streamlined lease accounting software built for companies of all sizes.

Eliminate the risk of overlooking critical lease events. Set consistent email alert rules across any or all leases immediately upon implementation.

Get set up fast. No matter what tool you previously utilized, it only takes a new user an average of seven minutes to learn and get started in our system.

Generate journal entries, quantitative footnote disclosures, and amortization schedules with the push of a button.

Integrated validation checks improve data input accuracy and ensure compliance with relevant standards and requirements.

While maintaining compliance with lease standards is difficult in Excel, our Reports Center provides pre-populated spreadsheets so you can easily update into any ERP system.

Having trouble with lease accounting? LeaseCrunch’s live or on-demand training and team of lease accounting experts are always available to help.

Having trouble with

The software was very user-friendly

Why waste your time doing all the calculations and tracking when someone else did all the work and created this for you at a great price? The software was very user-friendly, and I felt comfortable getting into it pretty quickly after a little training.

Everything you need to know about the lease accounting standards.

The Financial Accounting Standards Board changed the lease accounting game forever when they declared the ASC 842 new lease accounting standard.

The accounting landscape is rapidly evolving. Technology, client expectations, and market dynamics are reshaping how CPA firms operate. To thrive in...

First things first: Let’s set some definitions straight, because straight-line expense is different from straight-line amortization and straight-line...

Do you have lingering questions about transition leases and current lease accounting standards? In this blog, we answer the most common questions...

A sale and leaseback agreement is a transaction where the seller of an asset becomes the lessee and the purchaser becomes the lessor. Nothing changes...

Updated on April 10, 2023: The first amendment in this update allows for private and certain not-for-profit entities to use the written terms of the...

Written by Ane Ohm on Tuesday, August 6, 2019 It’s been a couple of weeks since the FASB announced its decision to potentially delay the...

FASB’s proposal to once again delay implementation of the new lease standard by one year for non-public companies brought some relief amid the...

The Financial Accounting Standards Board met on November 10, 2021 and decided not to further defer the new lease accounting standard implementation...

Schedule a demo today to try our best-in-class lease accounting software for free!