Cost-effective for even one lease. See how much time you could save here.

Compliant with standards ASC 842, IFRS 16, GASB 87, GASB 94, and GASB 96.

Export data into spreadsheets so you can import into any ERP.

Faster implementation with a streamlined interface, in-app tool tips, and guidance.

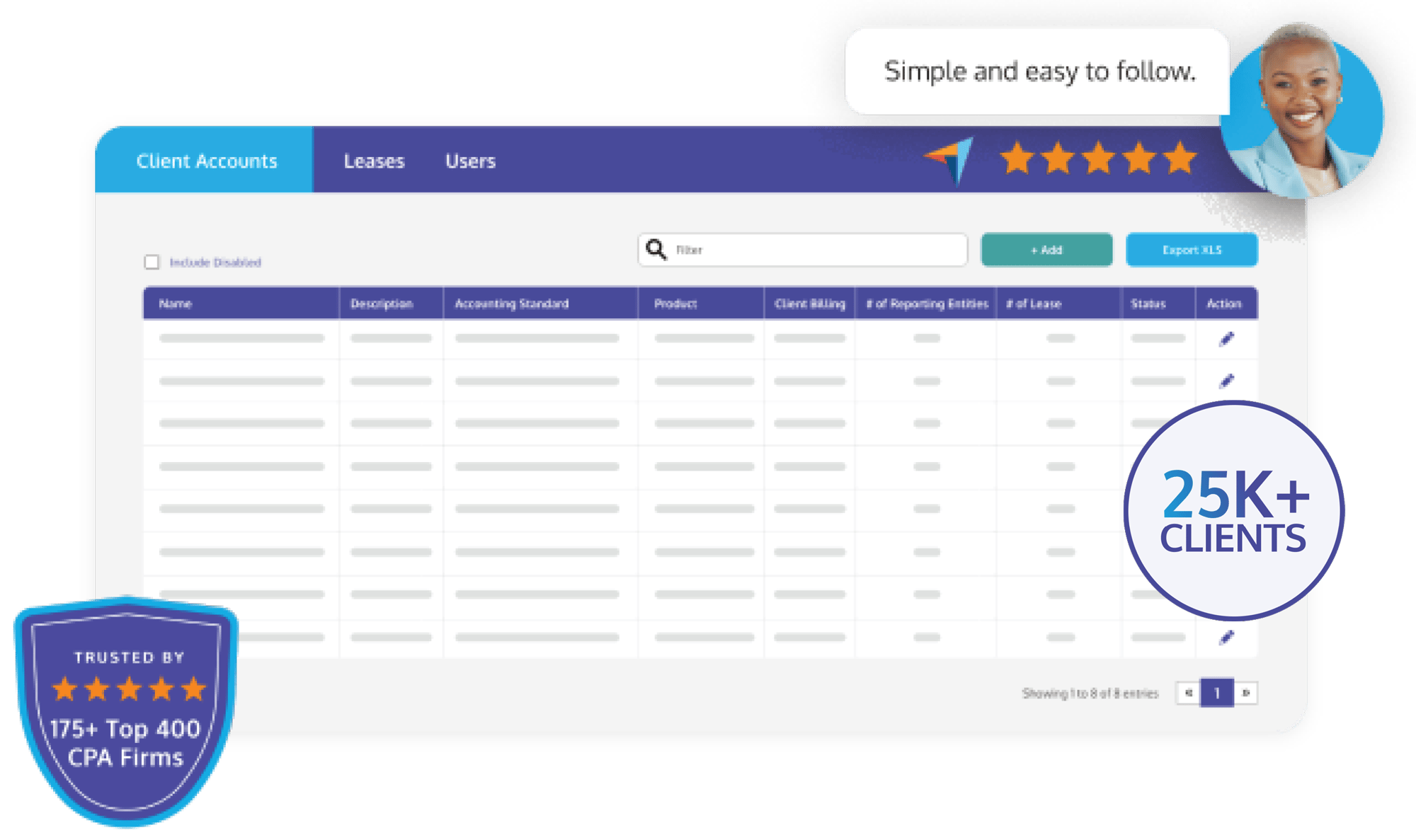

LeaseCrunch stood out because the workflow was simple and easy to follow

When researching different solutions, LeaseCrunch stood out because the workflow was simple and easy to follow, the implementation time was much faster, and they offer a help document to assist on the technical side. They also have several accountants and CPAs on staff to answer questions and help with unique situations. Overall, very happy with the product.

-

ASC 842

-

GASB 87

-

GASB 94

-

GASB 96

-

IFRS 16

Get started quickly with a streamlined, straightforward interface and in-app help links, wizards, and definitions that assist users in getting started with how to implement the new lease accounting standard.

While compliance with lease standards is difficult in Excel, our Reports Center provides journal entries, footnote disclosures and amortization schedules in spreadsheets so you can easily update ERP systems.

Our team is quickly available to help you with any software questions through our simple customer support process.

Our software is comprehensive and cost-effective, even for companies with just a single lease. See how much time you could save here.

Get Started in 4 Simple Steps:

- 1 Create and set up admin account

- 2 Invite staff or clients and assign user roles

- 3 Configure policies and enter lease data

- 4 Generate reports with the push of a button

CPA Firm Use Cases for LeaseCrunch

LeaseCrunch can be used independently or collaboratively with clients.

An accounting firm may choose to leverage LeaseCrunch and be the sole users of this software. This way all work for a client's lease accounting is done by the CPA firm.

Your CPA firm can invite their clients to use LeaseCrunch to enter their lease information with you. Both you and the client have access to the account and can generate the required reports.

Clients create their own accounts in LeaseCrunch and enter in their lease information. Once entered, the client generates the required reports and can remove firm access.

Stories from LeaseCrunch Customers

Automate Your Lease Accounting With Ease

Schedule a demo today to try our best-in-class lease accounting software for free!