Webinar Recording: Deep Dive: Accounting for Lease Modifications & Remeasurements Under ASC 842

For those already familiar with the basics of lease accounting, this session goes beyond the surface to tackle the complexities of lease modifications, remeasurements, and reassessments. This webinar walks through detailed examples and edge cases, giving you the tools to properly account for changes in lease terms, payment structures, and classification under ASC 842.

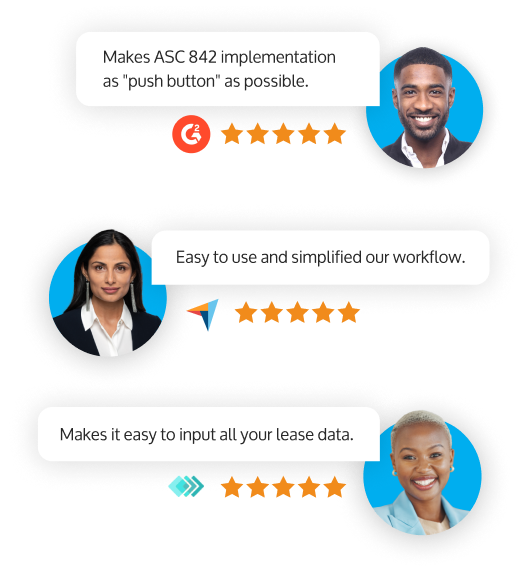

The Easy Way to Do Lease Accounting

-

Keep clients compliant with ASC 842, GASB 87/96, and IFRS 16

-

Expedite your clients’ lease accounting

-

Get step-by-step wizards to complete worry free calculations that comply with the new lease standard

-

Create error-free amortization schedules and entries

-

Save time with comprehensive policy templates that are designed to kick-off implementation

-

Modification or re-measurement calculations for revised leases

0

CPA Firms

0

Companies

LeaseCrunch is a simple, scalable, cloud-based solution that allows CPA firms and companies to automate the new lease reporting requirements with ease.