LeaseCrunch Blog

Read about ASC 842 & other lease accounting topics

Read about ASC 842 & other lease accounting topics

As we all expected, the Financial Accounting Standards Board (FASB) voted today that the new lease accounting standard will be delayed for one year for non-public companies. The decision comes three months after FASB proposed the delay for this and several other major accounting standards.

The new effective date for privately-held organizations to implement the new lease standard is the fiscal year starting after December 15, 2020. For many private companies, that means the effective date will be January 1, 2021.

FASB made the decision as part of a larger consideration of its overall philosophy for setting effective dates on major accounting standard changes. Historically, private companies have been given one year longer than public companies to implement major standard changes.

After studying the impact on private companies, FASB determined that those organizations would benefit from an additional year. FASB is implementing a new philosophy that all private companies will now receive two years between the public effective date and their effective date for major standard changes.

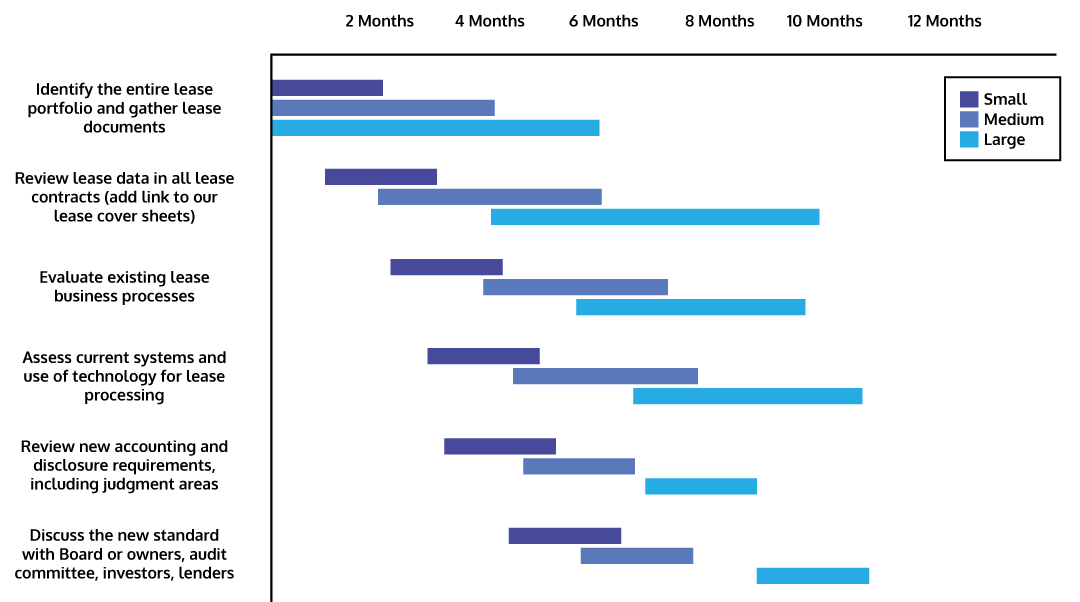

Now that the delay is decided, what’s the message for your clients? While it is true that your privately-held clients have 14+ months to implement the new standard, we still highly recommend taking action now. One of the biggest lessons learned from public organizations that have already implemented is just how lengthy and complex the process can be (see the chart below for time estimates).

Now is the perfect time for private companies to identify and audit their entire lease portfolio, along with making judgment-based policy decisions. Completing these critical steps will make crunching the numbers much easier in 2020.

One way your firm can add immense value to your private clients is by providing them with lease accounting software that vastly simplifies the implementation of the new lease standard.

To offer additional incentive for your clients to get started early, LeaseCrunch is offering a limited-time pricing special: two years of access for the price of one. Contact us today for more information!

Try the easiest lease accounting software on the market today!